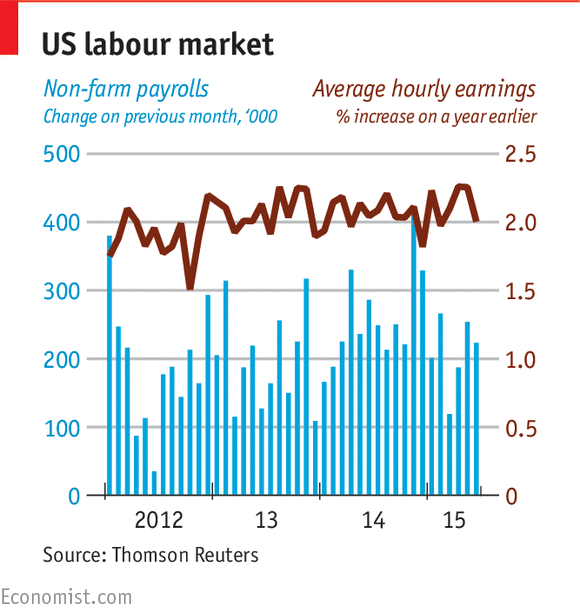

The economy churned out 215,000 new jobs in July, not as many as the 225,000 expected, not to mention the 246,000 average that was set over the previous 12 months. But it is still respectable. Unemployment stayed put at 5.3%, tantalisingly close to the 5-5.2% range that the Federal Reserve has labelled as “full employment”. Average wages rose by 5 cents per hour (0.2%), in line with expectations, and by 2.1% relative to the same month last year. Presidential candidates are falling over themselves to present their ideas for how to boost wage growth, and this month’s sluggish performance marks no departure from the past five years of disappointing figures.

Janet Yellen, the chair of the Federal Reserve, is facing the tricky decision of when exactly to raise rates. Today’s jobs figures add to the complicated tangle of information that she must grapple with. In a recent speech she said that she expected it to be appropriate to raise the federal funds rate at some point later this year, and two officials hinted there was support for a September rate rise. Bloomberg has also reported a surge in expectations that the next rate hike, to be the first in nearly a decade, will happen approximately that soon. Some have argued that only a catastrophic set of figures would have been capable of postponing a rate rise.

Friday’s figures were not those, but there is still a lot of uncertainty in the air. All of this guessing could be avoided if the Fed were to set its policy according to some fixed rule, which is the topic of this week’s Free Exchange column. Whereas this might make life easier for pundits (provided they manage to avoid compulsory redundancies), central bankers need to be able to respond flexibly to unexpected events, and to make nuanced decisions—and that requires discretion, which tends to create vagueness. Today’s figures will give the professional Fed-watchers something to ponder, but not enough to settle their question.